Building Wealth. Preserving Legacies.

Comprehensive Retirement, Insurance, and Wealth-Protection Solutions Licensed in All 50 States.

Preserve savings with tailored retirement and insurance plans.

Nationwide guidance to prevent coverage gaps.

Book online and receive a personalized plan quickly and easily.

Who we are

Creating Financial Security, Preserving What Matters.

With extensive experience and top carrier partnerships, we craft strategies to protect your future and legacy.

What We Do

Comprehensive Solutions to Protect and Grow Your Wealth

Mortgage Protection

Life Insurance & Final Expense

Fixed & Indexed Annuities

We are Specialize In

Financial & Insurance Solutions Tailored to You

Plan Your Future with Confidence

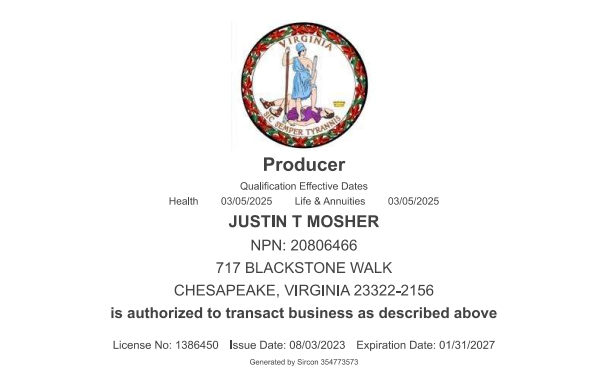

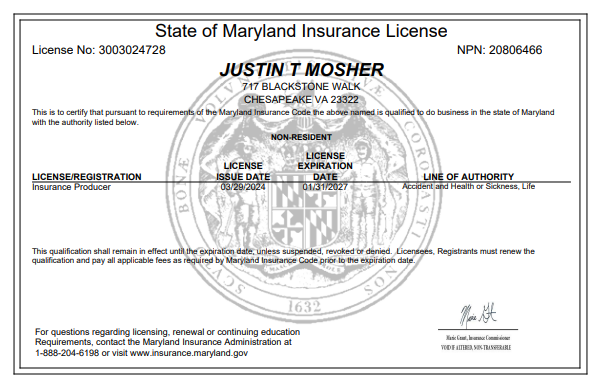

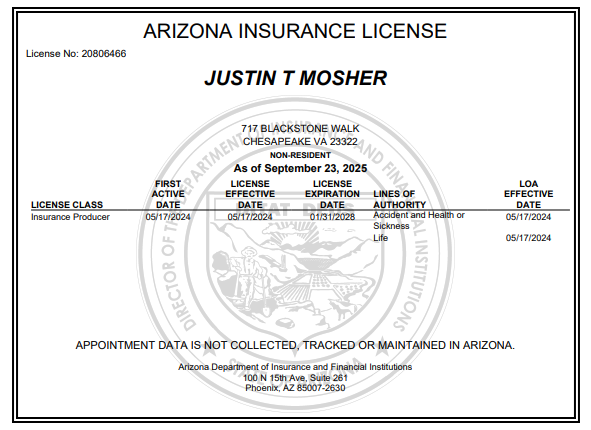

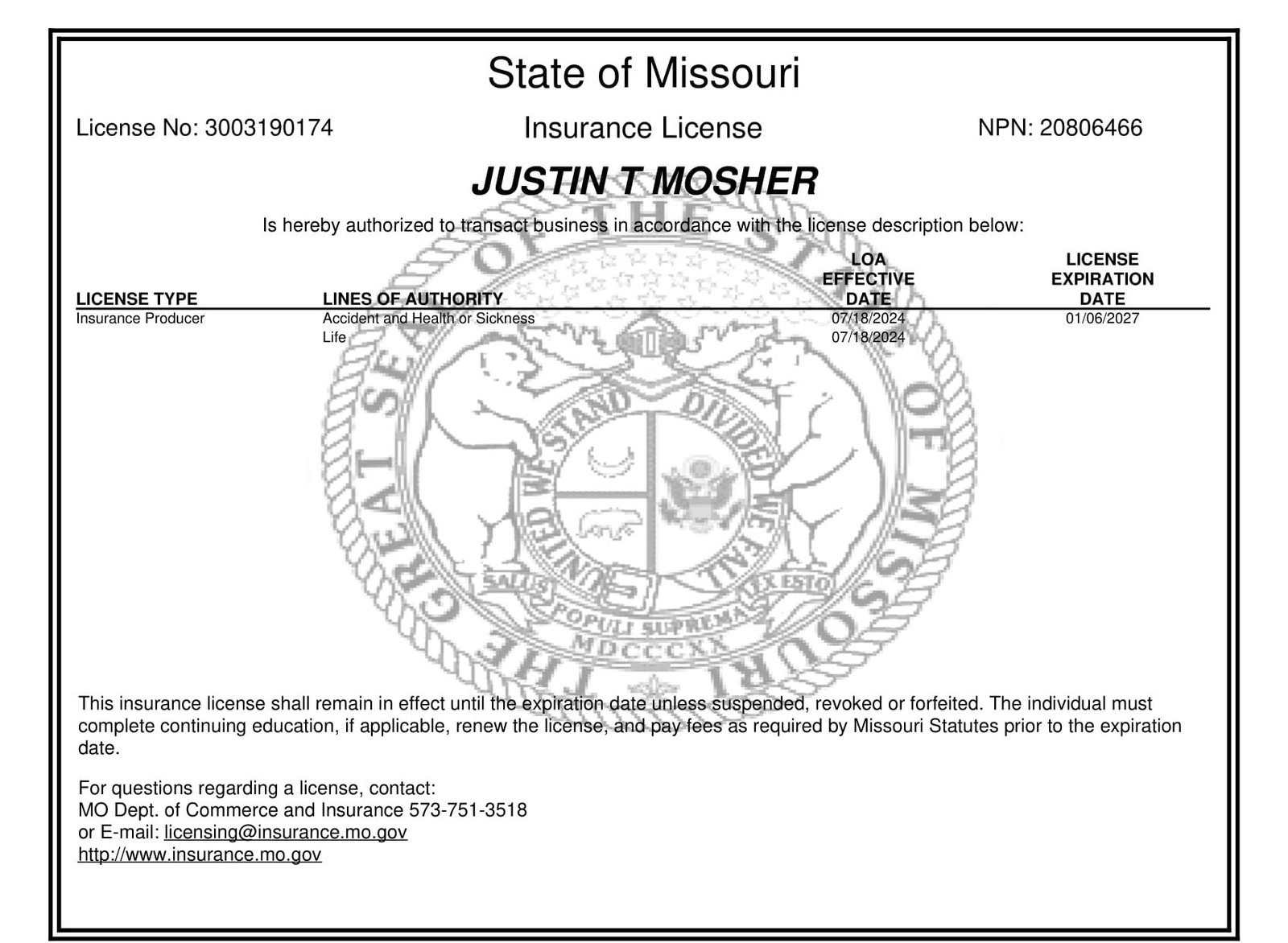

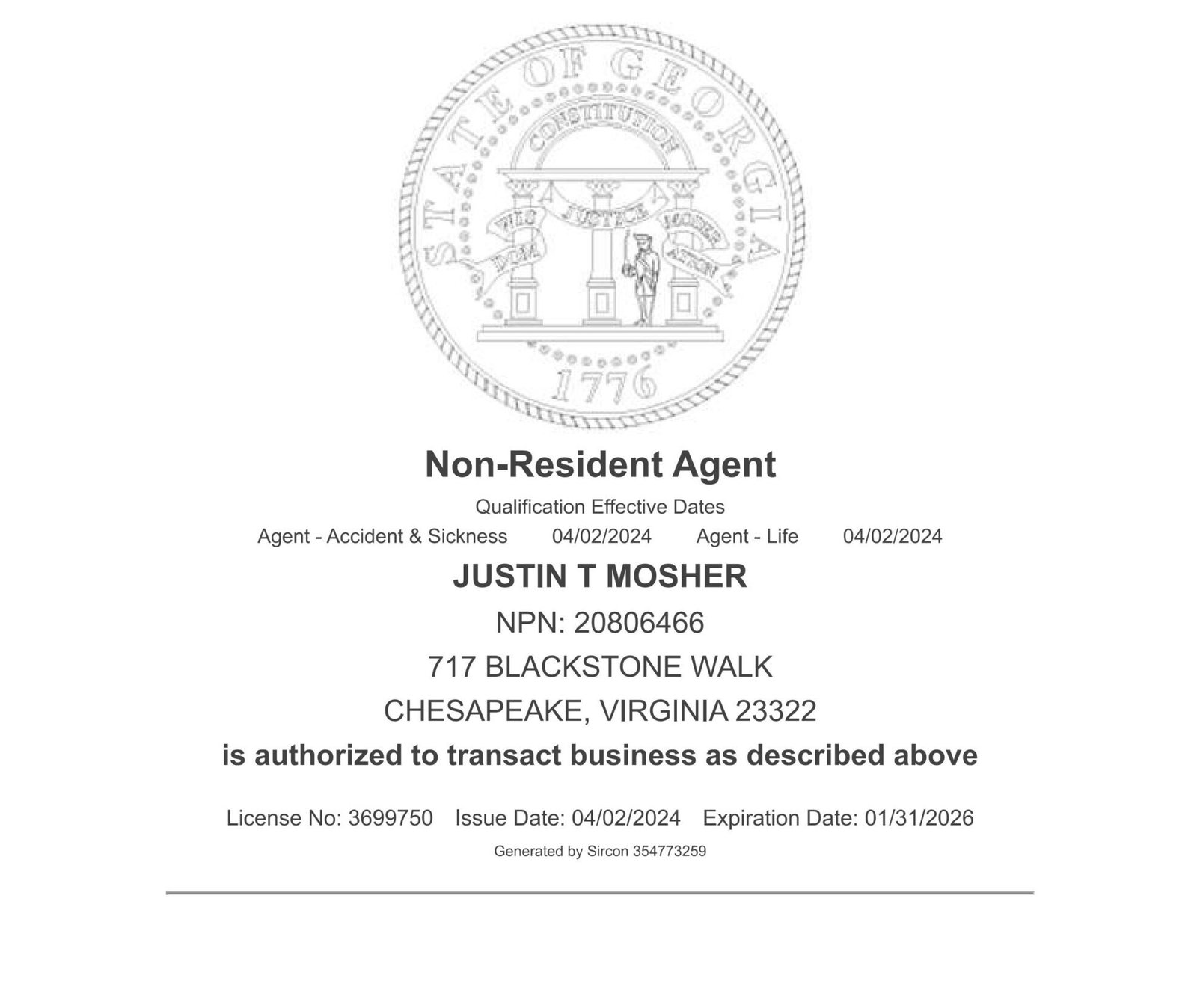

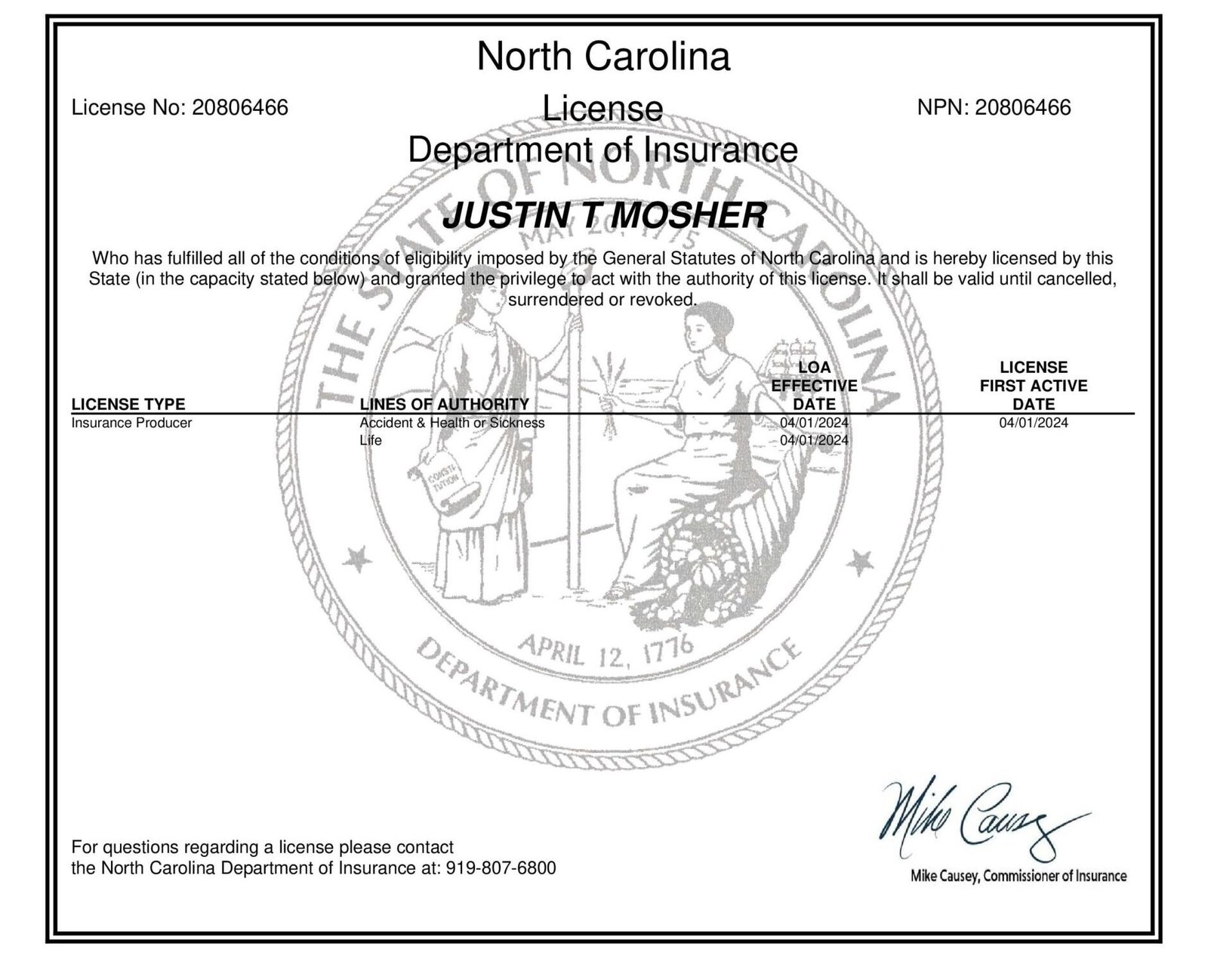

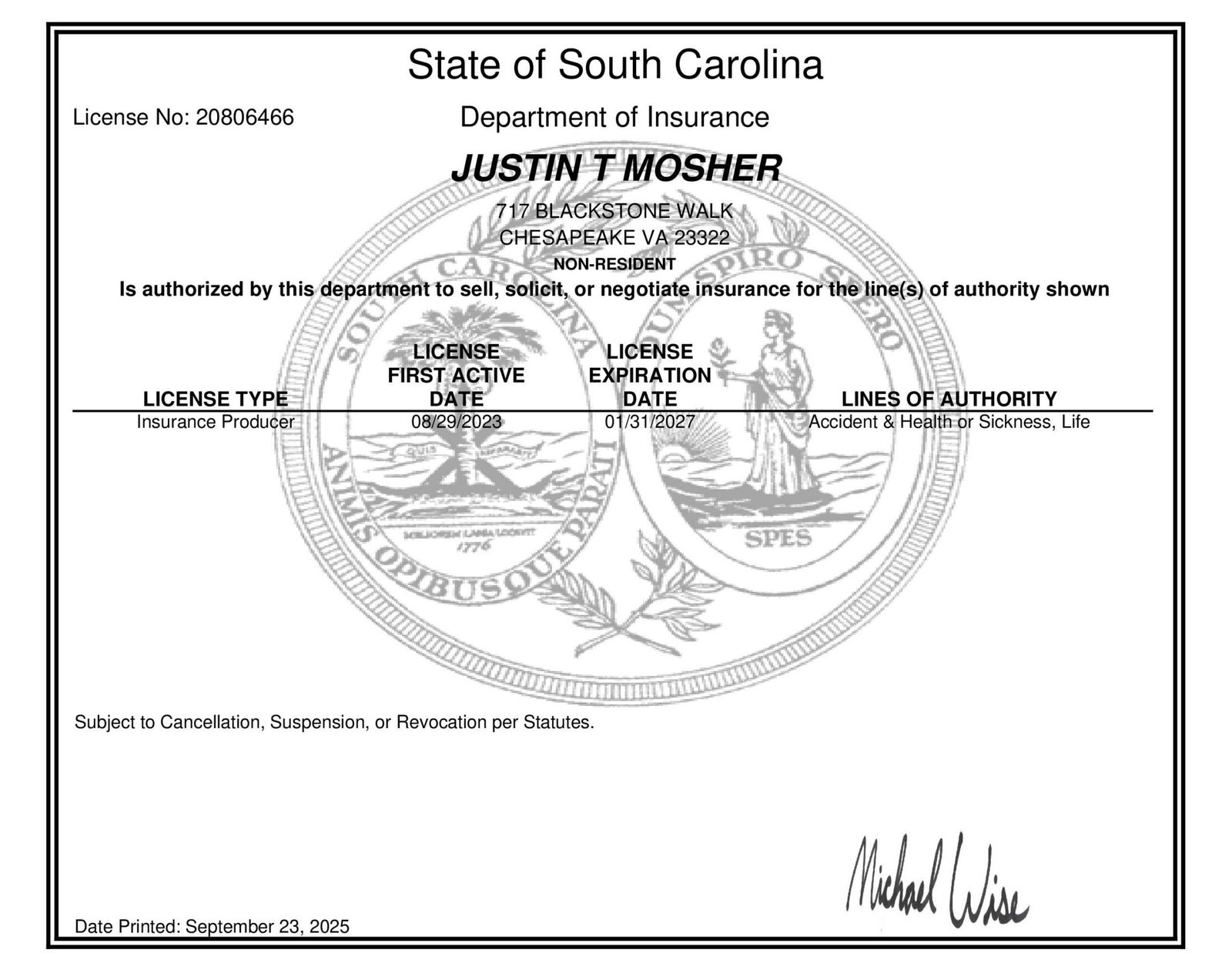

Licenses & Credentials

Licensed Nationwide. Trusted Everywhere.

We hold active licenses in all 50 states, ensuring you receive compliant, reliable financial and insurance guidance wherever you live.

State of Missouri

State of Georgia

North Carolina

South Carolina

Common Questions

Frequently Ask Questions.

What services do you offer?

We provide retirement planning, life insurance, mortgage protection, fixed & indexed annuities, 401(k)/IRA guidance, and long-term care coverage nationwide.

Are you licensed in my state?

Yes, we are licensed in all 50 states and can assist clients anywhere in the U.S.

Which insurance carriers do you work with?

We partner with multiple trusted carriers to offer you a range of options and competitive rates.

How do I book a consultation?

You can book a free consultation directly on this website through our secure online calendar.

Do you charge for initial consultations?

No, your first consultation is free and designed to understand your needs and goals.

Can you customize a plan for my situation?

Yes, every strategy is tailored to your unique financial goals and family’s needs.

What’s the difference between term life and final expense insurance?

Term life insurance provides protection for a set number of years, while final expense coverage is designed to cover end-of-life costs such as funeral expenses.

How do fixed and indexed annuities work?

Fixed annuities provide guaranteed interest, while indexed annuities allow growth tied to a market index, offering both protection and potential growth.

Do you offer mortgage protection?

Yes, mortgage protection insurance ensures your home is paid off or covered in case of death, disability, or critical illness.

What types of long-term care coverage do you offer?

I provide solutions for chronic, critical, and terminal illness care to help manage healthcare expenses and protect your financial future.

Do you work with both individuals and families?

Yes, I create customized strategies for individuals, couples, and families based on their unique financial goals.

Why choose you over an insurance company?

I represent multiple carriers, giving you unbiased options and tailored strategies instead of being limited to a single company’s products.